How Copilot Simplifies Financial Reconciliation in Microsoft Dynamics 365 Business Central

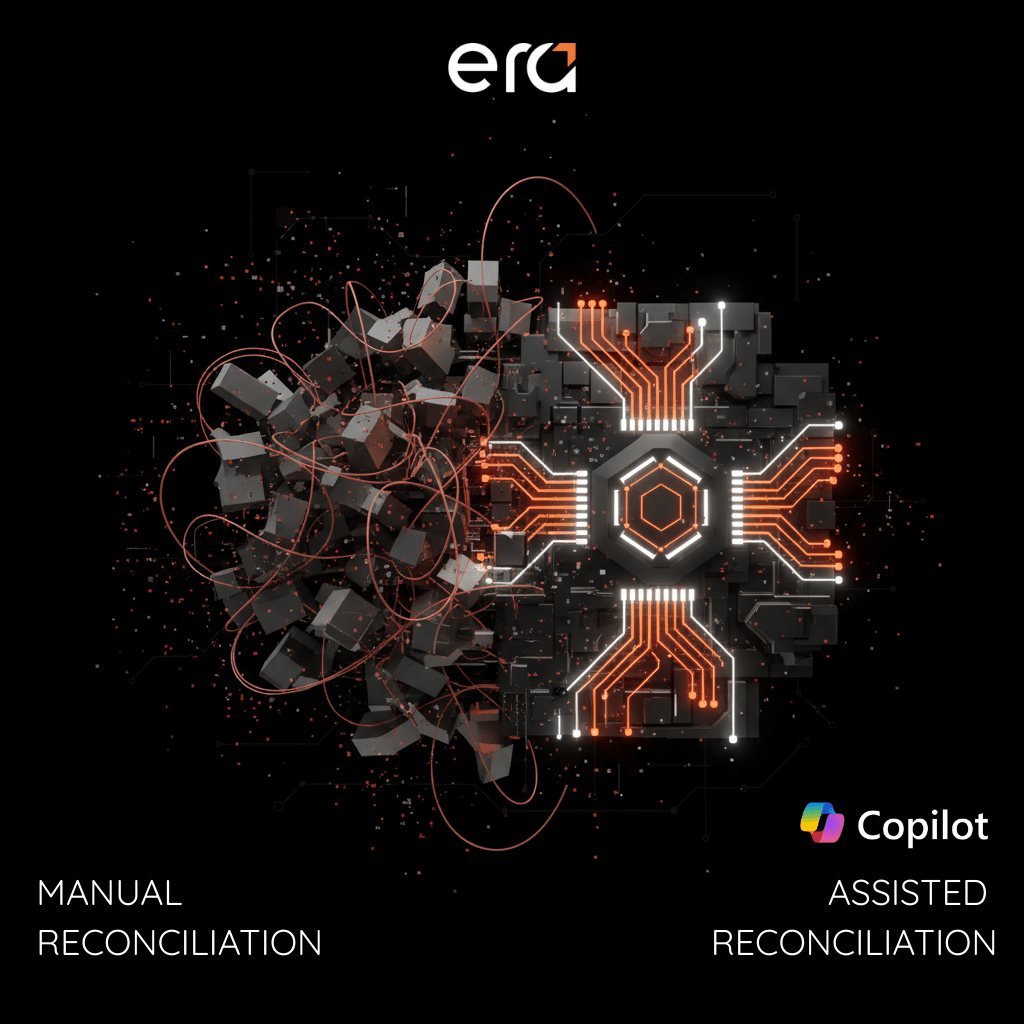

Financial reconciliation has never been anyone’s favorite task. Ask a finance manager what part of closing the books they’d gladly skip, and the answer is almost always the same: reconciling transactions. It’s tedious, it’s repetitive, and one small mismatch can snowball into hours of chasing numbers.

For small and mid-sized businesses, the pressure is even heavier. Month-end close often feels like a sprint, with lean finance teams racing to match transactions between bank statements, ledgers, and subledgers. A missing entry here or a timing difference there, and suddenly spreadsheets stretch late into the night. Every delay ripples into reporting, decision-making, and audit readiness.

That’s why so many finance leaders are asking: can artificial intelligence really make reconciliation easier?

With Copilot in Microsoft Dynamics 365 Business Central, the answer is starting to look like a solid yes. Copilot brings contextual suggestions, plain-language explanations, and a helping hand right where reconciliation gets messy. Think of it less like a machine running in the background, and more like a colleague pointing out exactly where the numbers don’t quite line up.

What Microsoft Copilot Brings to the Table

This is where things start to feel different. Copilot, now available in Microsoft Dynamics 365 Business Central, takes reconciliation beyond basic automation. Instead of just running rules in the background, it uses AI to actually assist finance teams in making decisions faster.

Here’s what that looks like in practice:

-

Smarter transaction matching

Copilot can suggest matches between bank transactions and ledger entries that aren’t obvious at first glance. Instead of manually scanning line by line, you get a curated list of likely matches to approve or adjust.

-

Plain-language explanations

Ever wondered why a transaction wasn’t matched? Copilot explains the reasoning in everyday language, so finance teams can act without second-guessing.

-

Proactive prompts

Instead of waiting for you to notice an issue, Copilot highlights duplicates, mismatches, or anomalies and asks, “Do you want to reconcile this?” It feels more like a conversation than a command line.

-

Conversational queries

Need to know what’s left unreconciled? Just ask. With Copilot’s natural language capabilities, you can type a question like “Show me unreconciled transactions for September” and get an instant answer without combing through reports.

The real difference is that Copilot isn’t just executing rules, but learning from context, surfacing the right suggestions, and cutting down the mental effort of reconciliation. Instead of battling spreadsheets, finance teams get to focus on judgment calls and analysis.

Benefits for Finance Teams

With Copilot in Microsoft Dynamics 365 Business Central, the focus shifts from technical capability to meaningful impact on how finance teams work and deliver results.

-

Faster month-end close

When transaction matching is accelerated, the entire closing process shortens. What once took hours of late-night spreadsheet work can now be handled in minutes, freeing teams to focus on analysis instead of manual checks.

-

Fewer errors, stronger audit trails

By surfacing likely matches and explaining discrepancies, Copilot helps reduce the small mistakes that often snowball into big headaches. Every action is recorded, which makes audits smoother and less stressful.

-

Less day-to-day stress

Finance professionals know the anxiety of missing a mismatch until the last minute. Copilot’s proactive prompts bring peace of mind, issues get flagged before they become emergencies.

-

Room to grow without extra hires

For SMBs, scaling transaction volumes usually means adding more people. With Copilot assisting reconciliation, the same lean team can handle growth without burning out.

At the core, Copilot is about shifting the balance of work. Finance teams spend less time chasing errors and more time providing insights that actually support decision-making. And that shift is exactly what most CFOs and controllers have been waiting for.

Reality Check: What Copilot Doesn’t Do (Yet)

As promising as Copilot sounds, it’s important to keep both feet on the ground. AI isn’t a replacement for financial oversight, and reconciliation still requires a human touch.

Copilot can suggest matches, highlight anomalies, and explain differences, but it doesn’t know your full business context. A transaction could be flagged as a likely match, yet only someone familiar with your contracts or vendor agreements can confirm it’s correct.

It also doesn’t eliminate the need for policies, controls, or approvals. Finance leaders remain accountable for final sign-offs, compliance with accounting standards, and interpreting what the numbers mean for strategy. In other words, Copilot is an assistant, not an auditor.

And like any AI tool, its effectiveness depends on setup and data quality. If the underlying data in Dynamics 365 Business Central isn’t clean, Copilot’s suggestions won’t be either. The “garbage in, garbage out” principle still applies.

Acknowledging these limits matters. It reassures that while Copilot can reduce drudgery and speed up reconciliation, it won’t replace the judgment, and that’s a good thing. \

Who Can Access Copilot in Dynamics 365 Business Central?

One question many finance leaders have is whether Copilot is something they can start using right away in their ERP. The short answer: it depends on your setup.

Copilot is available for customers using the cloud version of Microsoft Dynamics 365 Business Central. It’s included as part of the platform, not as an extra module or separate license, but only in the online environment. Businesses running an on-premises version of Dynamics 365 Business Central won’t have access to Copilot today.

Availability can also vary depending on your region and which product update wave your environment is on. Microsoft continues to roll out new Copilot features gradually, so what’s live in one tenant may not yet be active in another. The best way to confirm is by checking with your Microsoft partner to see if Copilot has been enabled in your instance.

Era Consulting Group’s Perspective: Making Copilot Work for Your Business

Every finance team reconciles differently. Some rely on simple bank feeds, others manage multiple entities, foreign currencies, or complex intercompany transactions. That’s why Copilot in Dynamics 365 Business Central isn’t a plug-and-play fix, it needs to be shaped around your processes.

This is where our team comes in. We’ve worked with SMBs across finance, manufacturing, distribution, professional services, and one thing is always true: technology delivers value only when it’s configured to fit the way your business actually operates.

When it comes to reconciliation with Copilot, we help our clients:

-

Set up Microsoft Dynamics 365 Business Central so the right data flows into reconciliation.

-

Fine-tune Copilot’s suggestions to match the company’s chart of accounts and posting rules.

-

Train finance teams to interact with Copilot confidently, knowing when to trust suggestions and when to override them.

-

Support continuous improvement, because AI models evolve, and so do businesses.

The result is a finance function that spends more time providing insight and less time chasing mismatched transactions. Copilot becomes a reliable partner in the close process, and Era Consulting Group makes sure it’s a partner that truly works for you.

Turning Reconciliation Into Relief

Reconciliation will probably never be anyone’s favorite part of accounting. But with Copilot in Microsoft Dynamics 365 Business Central, it doesn’t have to be the dreaded bottleneck that drains every month-end close. By suggesting matches, flagging anomalies, and explaining discrepancies in plain language, Copilot gives finance teams the breathing room they’ve been missing.

For SMBs, that shift can be game-changing. Less time stuck in spreadsheets means more time understanding what the numbers actually say about the health of the business. And when audits or board meetings come around, the confidence of having clean, reconciled data speaks for itself.

At Era Consulting Group, we believe artificial intelligence should make work simpler, not more complicated. That’s why our team helps businesses configure Dynamics 365 Business Central and Copilot in ways that reflect their real processes. Reconciliation stops being a headache, and finance leaders get back the time and clarity they need.

FAQ

What is financial reconciliation in Dynamics 365 Business Central?

Financial reconciliation is the process of matching transactions recorded in Microsoft Dynamics 365 Business Central with external records, such as bank statements, to ensure accuracy and completeness.

How does Microsoft Copilot help with reconciliation?

Copilot suggests transaction matches, explains discrepancies in plain language, and flags anomalies, helping finance teams close books faster and with fewer errors.

Does Copilot replace accountants or controllers?

No. Copilot supports finance teams by reducing repetitive work, but final oversight, approvals, and strategic decisions remain with human professionals.

Is Copilot available in all versions of Dynamics 365 Business Central?

Copilot is being rolled out gradually across Dynamics 365 apps, including Business Central. Availability depends on licensing, region, and product updates.

Can small businesses benefit from using Copilot for reconciliation?

Yes. SMBs with lean finance teams gain time savings, error reduction, and audit-ready data without needing to expand staff.

Who can access Copilot in Dynamics 365 Business Central? Is it free?

Copilot is included with the cloud version of Microsoft Dynamics 365 Business Central and doesn’t require an additional paid module. However, it’s not available in on-premises versions, and rollout timing may differ by region and product update cycle. Customers should check with their Microsoft partner to confirm availability.