ERP Finance: More Than Accounting Software, a Strategic Financial Management Tool

Managing company finances has never been simple. Between endless Excel spreadsheets, tedious reconciliations, and constantly changing tax rules, businesses often lose valuable time, and sometimes money. Without a clear, centralized view, decision-making becomes guesswork.

That’s where an ERP finance comes in. Unlike basic accounting software, an ERP system isn’t just about recording numbers. It’s a complete platform that connects accounting, budgeting, compliance, and even operational data. The result? Fewer errors, greater transparency, and financial management that finally keeps pace with business growth.

In Canada, more and more SMBs are turning to an ERP financial management software to modernize how they run finance. They want more than compliance with CRA and Revenu Québec requirements. They want reliable forecasts, real-time reporting, and the ability to make finance a strategic asset instead of a simple back-office function.

This article will explore how finance ERP systems deliver concrete benefits. From daily accounting automation and audit readiness to smarter budgeting and multi-currency management, you’ll see why an ERP finance is far more powerful than most expect.

What is an ERP finance?

Before diving into benefits, let’s clarify what we mean by an ERP Finance. An ERP (Enterprise Resource Planning) system is a platform that centralizes multiple business functions. Its financial component covers all the modules that manage accounting, cash flow, budgeting, and regulatory compliance.

Unlike traditional accounting tools, which often stop at journal entries and basic reports, an ERP Finance goes much further. It connects finance with other departments (sales, purchasing, even production) providing a complete picture of a company’s financial health. This shifts finance from a back-office task to real-time strategic management.

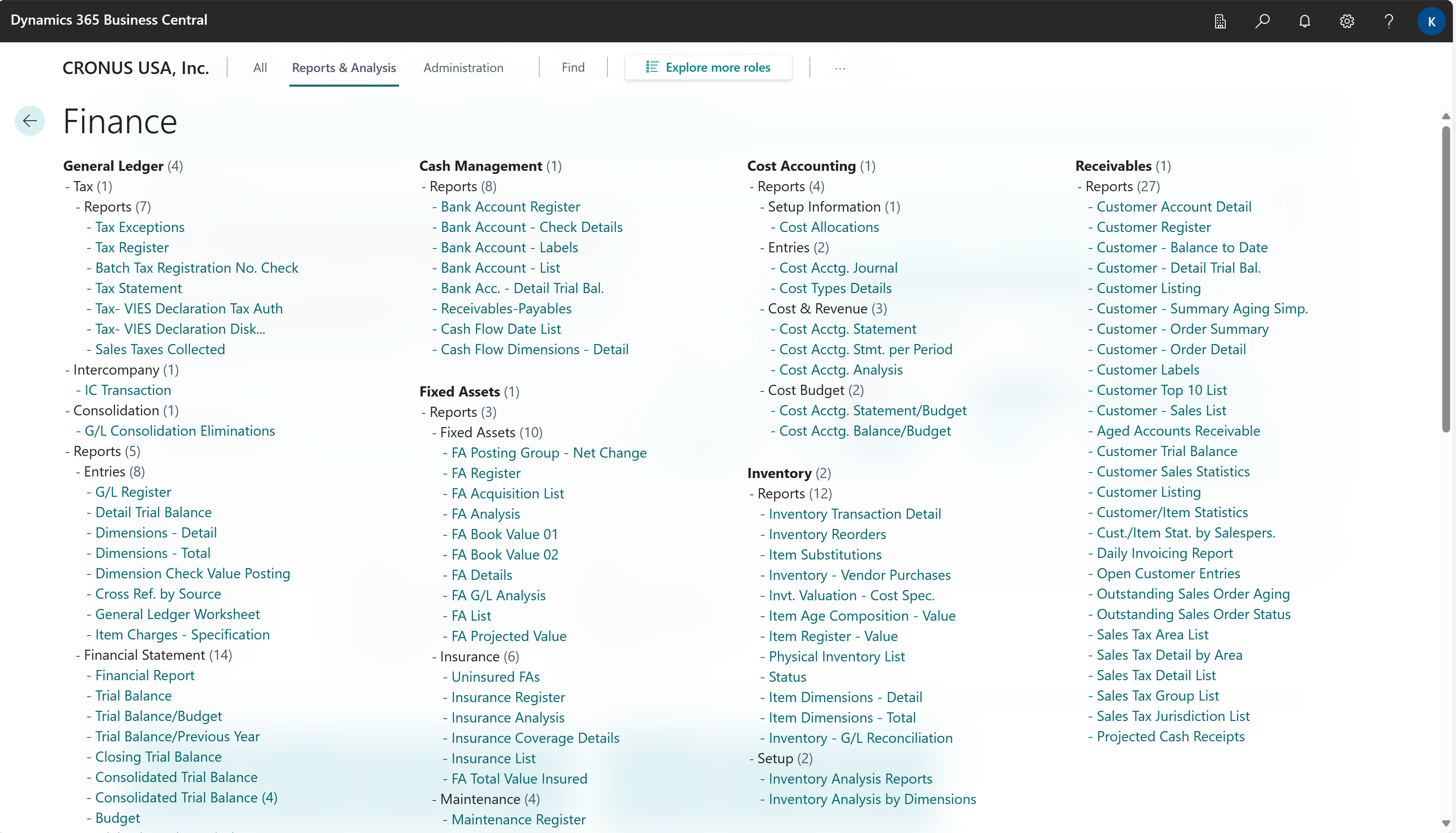

Typical modules in an ERP financial management system include:

-

General Ledger: the core accounting book, where all entries are centralized.

-

Accounts Receivable and Accounts Payable (AR/AP): managing invoices, collections, and supplier payments.

-

Budgeting and Forecasting: planning, adjustments, and variance tracking.

-

Cash Management: monitoring inflows and outflows to anticipate liquidity needs.

-

Financial Reporting and Dashboards: real-time KPIs and insights for decision-makers.

-

Compliance and Audit: meeting accounting standards (IFRS, GAAP) and tax obligations (GST, QST, CRA).

Think of ERP Finance as a financial control tower. While accounting software is like a simple logbook, ERP gives you a panoramic view: it captures every piece of data, connects the dots, and delivers insights to the right people at the right time. The outcome? Leaders make better decisions, and finance teams work more efficiently.

Key Benefits of ERP Finance

Adopting an ERP financial management system isn’t just about modernizing accounting. It’s about transforming how businesses handle finance every day and how they prepare for the future. Here are the main benefits an ERP finance delivers.

1. Automated Accounting: Less Error, More Time

Anyone who’s spent hours on duplicate entries or month-end reconciliations knows how draining they can be. With an ERP Finance, much of that repetitive work is automated. Journal entries generate automatically from sales or purchase transactions, and bank reconciliations become faster and more reliable.

This reduces the risk of human error and frees finance teams to focus on higher-value activities like cost analysis, forecasting, or strategic advising.

2. Real-Time Reporting for Faster Decisions

Waiting until the quarter’s end to know where the business stands financially is no longer realistic. An ERP financial management software provides instant reports and interactive dashboards. Leaders can see cash flow, liabilities, revenues, and margins in real time.

It’s like switching from a still photo to a live video feed, you’re not looking at the past anymore, you’re following what’s happening in the present. That agility makes all the difference when deciding on an investment or adjusting budgets.

3. Compliance and Audit Readiness

Between accounting standards (IFRS, GAAP), federal and provincial taxes (GST, QST), and CRA audits, compliance can quickly become overwhelming. A Finance ERP systems simplify this by embedding local rules and generating ready-to-submit reports.

When it comes to an audit, or even preparing documentation for funding or subsidies, all financial information is centralized and traceable. That reduces stress and speeds up verification. Instead of chasing scattered documents, finance teams have everything at their fingertips.

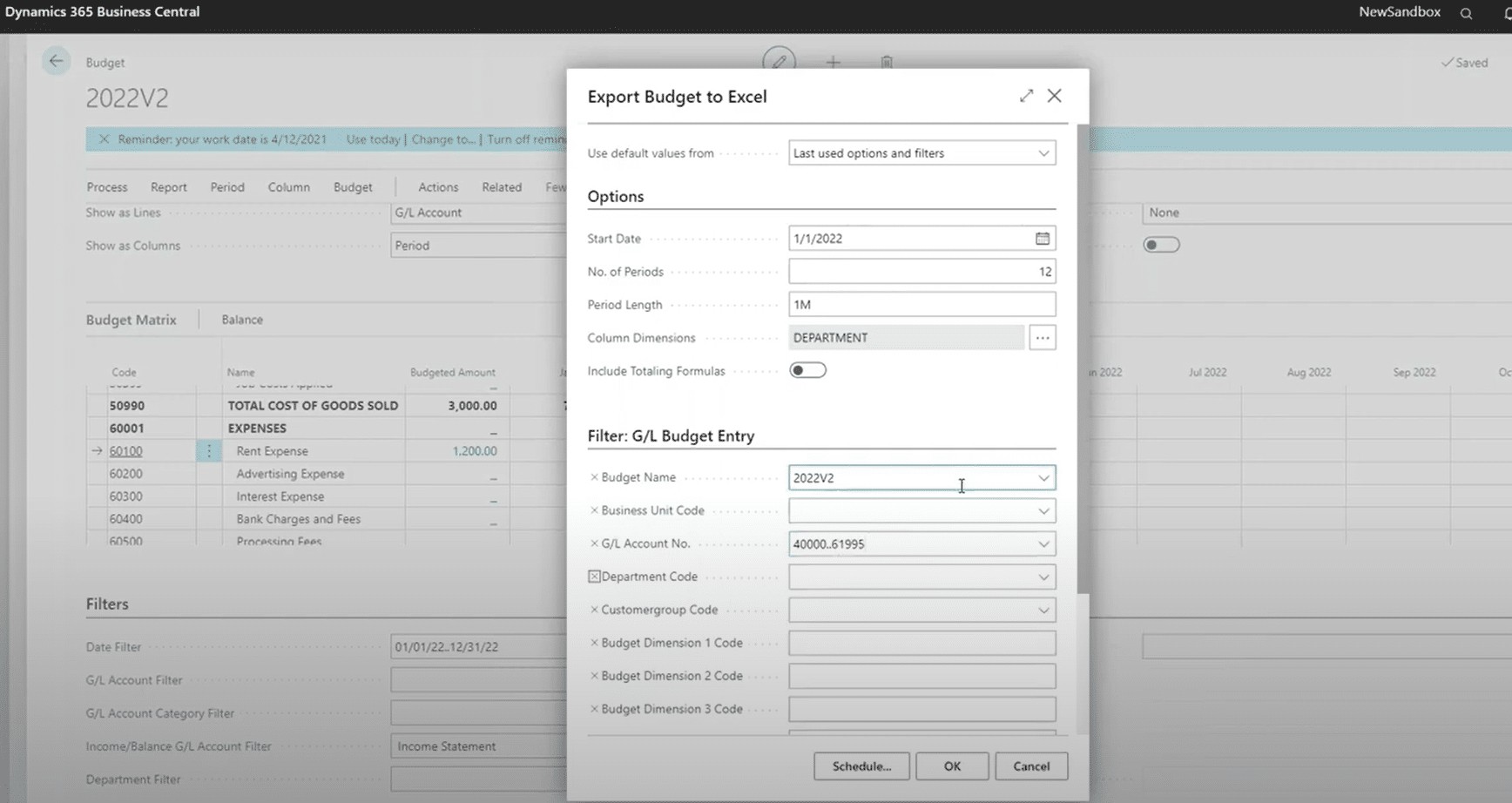

4. More Accurate Budgeting and Forecasting

Looking ahead with confidence is essential. An ERP finance includes budgeting and forecasting tools that let businesses model scenarios, compare forecasts with actuals, and adjust budgets continuously.

Some platforms, like Microsoft Dynamics 365 Business Central, even leverage artificial intelligence to generate predictions based on historical data. This means decisions are guided not by guesswork, but by reliable insights.

5. Stronger Cash Flow Management

Cash is the lifeblood of every company. With an ERP financial management software, businesses gain real-time visibility into inflows and outflows, making it easier to anticipate liquidity needs. This strengthens negotiations with banks, supports investment planning, and helps avoid unpleasant surprises.

In practice, effective cash flow monitoring becomes a growth enabler, not just a defensive exercise.

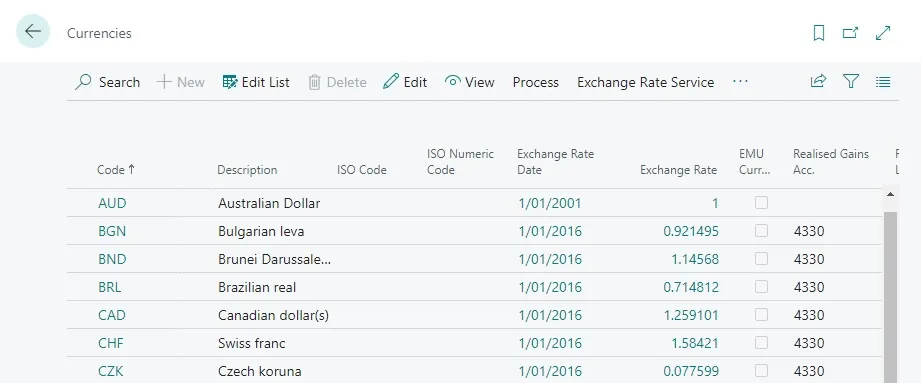

6. Multi-Currency and Multi-Entity Simplicity

Many Canadian companies operate internationally or manage subsidiaries across borders. An ERP finance simplifies multi-currency and multi-entity management by consolidating all financial operations in one system.

That eliminates wasted hours on manual conversions or Excel consolidations while ensuring financial consistency across the group.

7. Cross-Functional Visibility Through Integration

Finance doesn’t exist in a vacuum. By linking financial data with sales, procurement, or supply chain operations, an ERP finance provides a full view of business performance. Suddenly, you can see the financial impact of a delayed supplier delivery or a large customer order.

This cross-functional visibility enables leaders to make smarter, more strategic decisions because financial data is always placed in the context of real business activity.

ERP finance in Canada

Implementing an ERP finance isn’t just about modernizing accounting. In Canada, companies face unique requirements: tax compliance, bilingual invoicing, and different market contexts from province to province. The right ERP financial management system can absorb these complexities without adding extra work for finance teams.

Take invoicing as an example. Many Quebec businesses must provide invoices in both French and English. With a solution like Microsoft Dynamics 365 Business Central, this process can be automated. At the same time, the system ensures that federal and provincial tax rules are applied correctly. The result? Less administrative friction and smoother operations for customers in Montreal, Toronto, or Vancouver.

Compliance is another major issue. From GST and QST to IFRS standards and CRA audits, finance teams need precision and traceability. With finance ERP systems, all data is centralized and audit-ready. For SMBs that don’t have large accounting departments, this is a major advantage that reduces errors and avoids costly penalties.

Finally, the Canadian market is defined by its strong base of small and mid-sized businesses. These companies need solutions that are both powerful and flexible: ERP systems that can scale with growth, but that don’t burden teams with unnecessary complexity. That’s exactly what Dynamics 365 Business Central offers, robust enough for expansion, but agile enough for SMB realities.

In short, in Canada, an ERP finance isn’t just accounting software. It’s a strategic ally that adapts to local realities while supporting long-term growth.

ERP Finance and Emerging Trends: AI and Cloud

Finance management isn’t immune to technology shifts. Today, two major trends are reshaping how companies run their finances: artificial intelligence (AI) and the Cloud.

Artificial Intelligence: Anticipating Instead of Reacting

With AI built into ERP systems, financial forecasting is no longer limited to static spreadsheets. An ERP finance platforms can analyze historical data, detect anomalies, and even recommend actions. Imagine being alerted about a customer’s potential late payment before it happens, or getting budget adjustments suggested based on seasonal sales patterns.

This turns an ERP finance into a digital financial assistant, helping leaders anticipate problems instead of reacting after the fact.

Cloud ERP: Accessible, Flexible, and Secure

The shift to Cloud-based ERP has also transformed financial management. Cloud solutions give teams secure access to financial data from anywhere, whether at the office, working remotely, or on the move. For managers juggling multiple roles and locations, this accessibility is invaluable.

Security is another strong point. Contrary to what some might think, Cloud ERP often offers better protection than on-premise systems, thanks to features like automatic updates, advanced encryption, and continuous backups.

A Future-Ready Finance Function

By combining AI and Cloud, ERP Finance has become more than a management tool, it’s a strategic cockpit for the entire business. For Canadian SMBs, this means access to cutting-edge technology without heavy infrastructure costs. Finance evolves from an administrative burden into a driver of long-term resilience and growth.

How to Choose the Right ERP Finance

With so many solutions on the market, selecting the right ERP financial management software can feel overwhelming. But a few clear criteria can help distinguish between a platform that becomes a true partner and one that risks slowing you down.

1. Adaptability to Your Business

An ERP should grow with you. SMBs don’t have the same needs as large enterprises, but both require flexibility. Your chosen solution should handle your current operations while scaling for future growth, without forcing a complete system change in just a few years.

2. Integration with Existing Tools

An ERP finance doesn’t operate in a silo. Make sure it connects seamlessly with your sales, procurement, CRM, and supply chain systems. The smoother the integration, the more naturally your data flows, and the less manual entry your teams have to do.

3. Compliance with Local Requirements

For businesses across Canada, compliance isn’t optional. Check that the ERP covers local standards: GST/QST, CRA requirements, bilingual invoicing. Overlooking these details can quickly turn into major headaches.

4. Ease of Use

An ERP doesn’t have to be complex to be powerful. If your teams can’t adopt it quickly, the investment is wasted. Look for an intuitive, user-friendly interface that adapts to your people, not the other way around.

5. Cost and True Value

Beyond license fees, think about the total cost: maintenance, updates, training. But flip the question too: what will the ERP save you? If it reduces errors, secures compliance, and speeds up decision-making, the return often outweighs the investment.

Turning Finance Into a Strategic Driver

Financial management shouldn’t be a burden, it should be a lever for growth. By automating accounting, providing real-time reporting, and simplifying compliance, an ERP Finance transforms what’s often seen as back-office administration into a true decision-making hub.

For Canadian and Quebec businesses, choosing the right ERP is even more crucial. The system must meet local requirements while staying open to international growth. Whether you’re a fast-scaling SMB or a larger organization, a solution like Microsoft Dynamics 365 Business Central offers the flexibility, compliance, and visibility you need to make better decisions faster.

But remember: choosing the software is only half the battle. The partner guiding your ERP implementation is just as critical. To help you prepare, here is 9 criteria for successfully choosing your ERP implementation partner.

FAQ

What is the difference between ERP and accounting software?

An accounting software mainly records transactions and generates basic reports. An ERP , finance goes further by integrating finance with sales, purchasing, and operations to give a complete view of business performance.

Is an ERP finance suitable for Canadian SMBs?

Yes. Solutions like Microsoft Dynamics 365 Business Central are designed for small and mid-sized businesses. They’re powerful enough to support growth but simple enough to implement and use.

How does ERP help with compliance in Canada?

ERP Finance systems embed local tax and accounting rules, including GST, QST, CRA requirements, and IFRS standards. They generate compliant reports and keep all data traceable for audits or funding requests.

How much does an ERP finance cost in Canada?

Costs vary depending on company size, number of users, and modules. Instead of focusing only on license fees, consider ROI: reduced errors, better compliance, and faster decision-making often offset the investment.

What are the most popular ERP finance systems in Canada?

Top solutions include Microsoft Dynamics 365 Business Central for SMBs, Oracle NetSuite for high-growth companies, and JD Edwards or larger organizations.